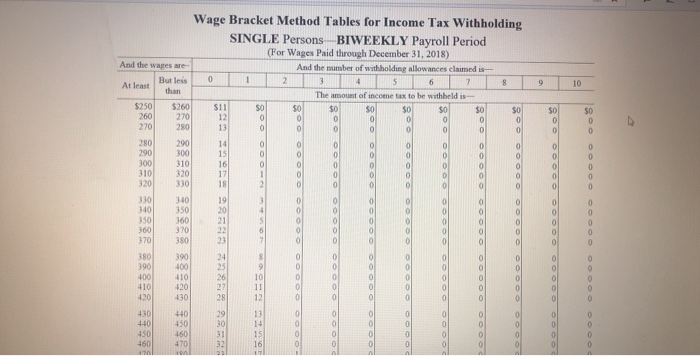

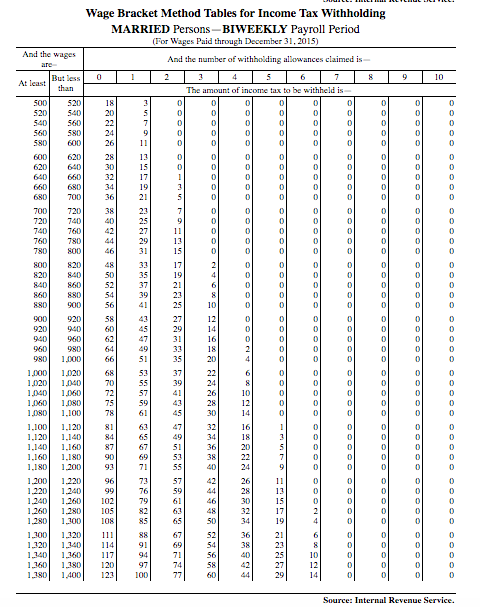

Federal Tax Withholding Tables Biweekly

In this example the employer would withhold 32 in federal income tax from the weekly wages of the nonresident alien employee. For more information about withholding on supple-mental wages see section 7 of Pub.

Note If Applicable The Tax Tables Can Be Used To Chegg Com

15-T Federal Income Tax Withholding Methods along.

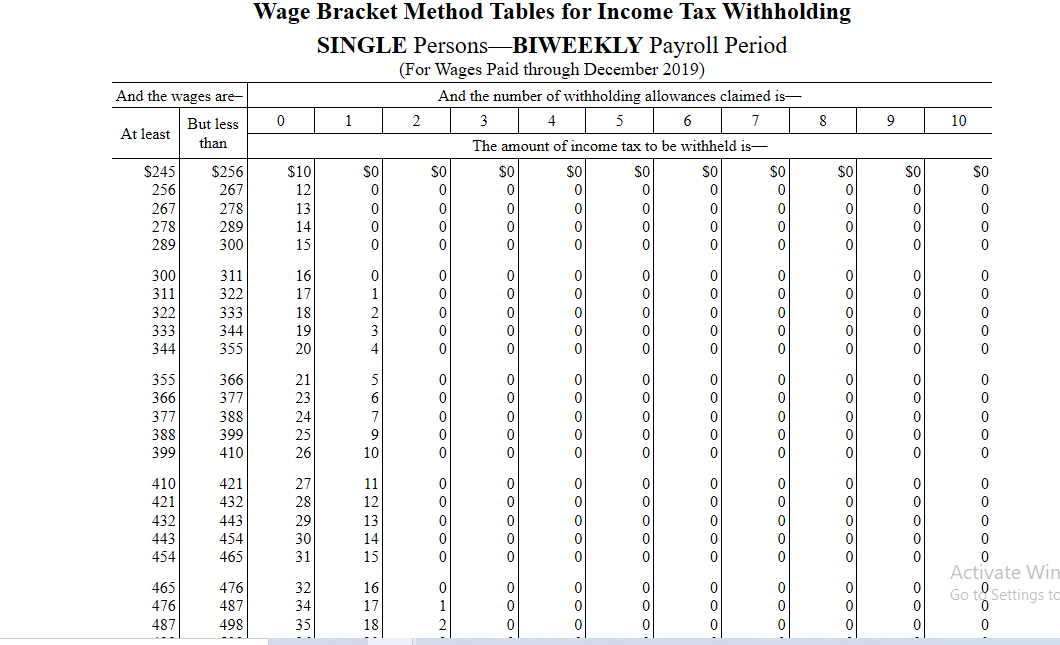

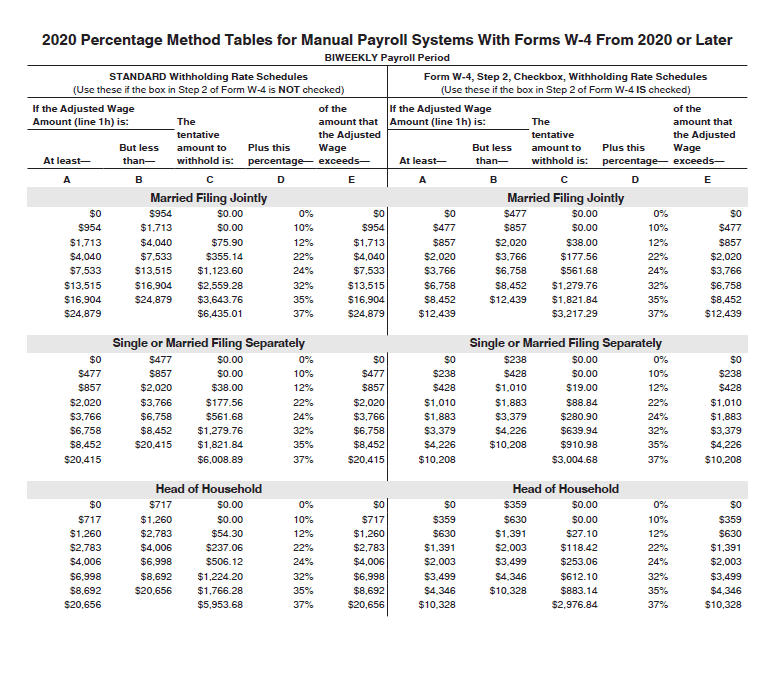

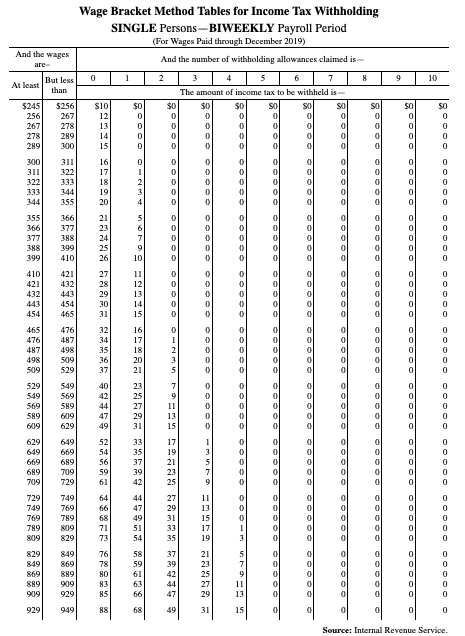

Federal tax withholding tables biweekly. Divide the annual Federal income tax withholding calculated in step 9 by the number of pay dates in the tax year to obtain the biweekly Tentative Federal Withholding amount. Read further to recognize how the process functions formally. 2021 Tax Tables Federal The complete guidelines of Federal Income Tax Withholding are issued by the IRS Internal Revenue Service each year.

This year of 2021 is additionally not an exemption. Because the employees tax situation is simple you find that their adjusted wage amount is the same as their biweekly gross wages 2020. Federal Income Tax Withholding Tables 2021.

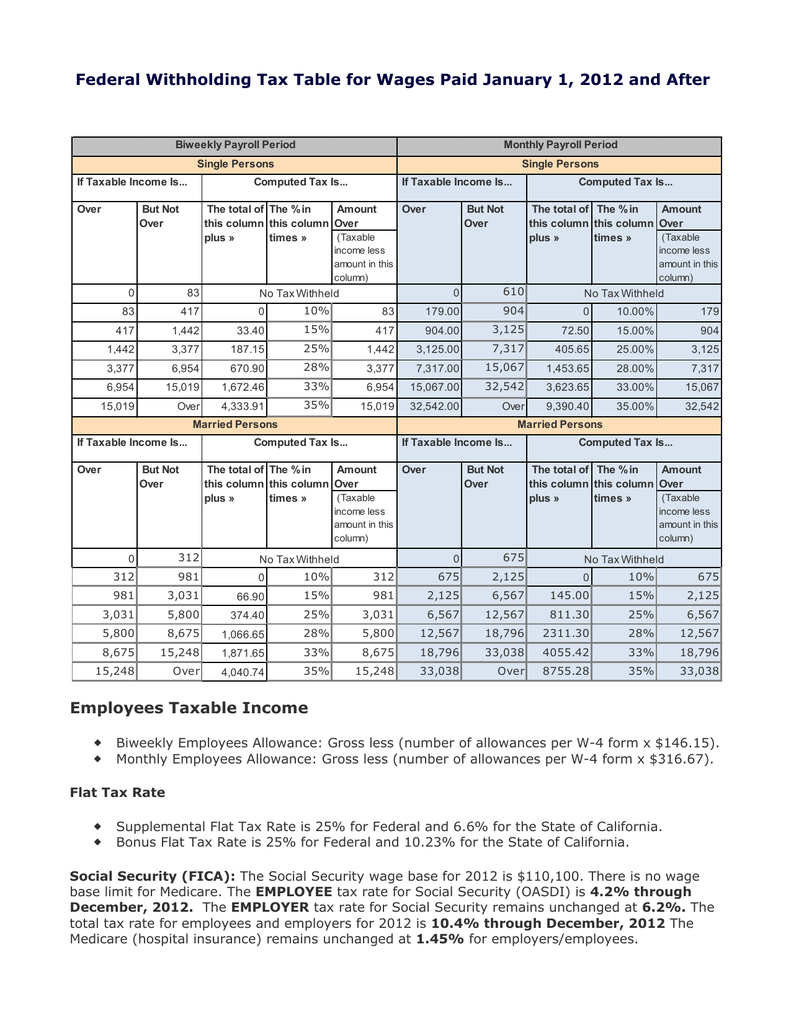

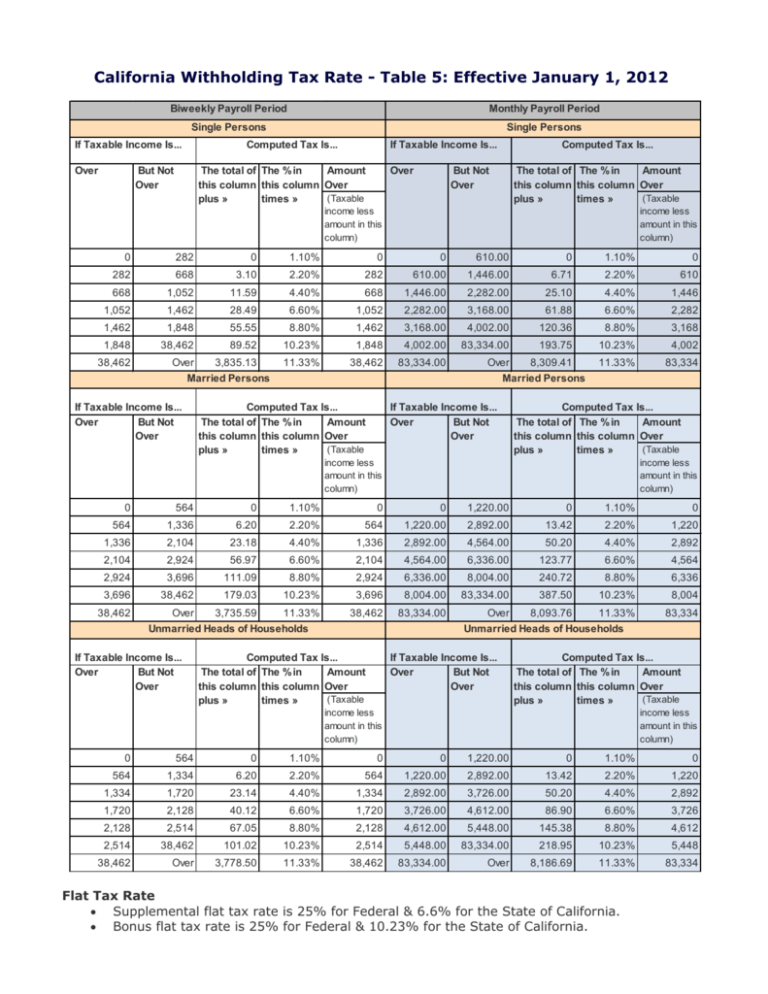

Although this publication may be used to figure federal income tax withholding on periodic payments of. Rate withholding applies or if the 22 optional flat rate withholding is used to figure federal income tax withhold-ing. The overview may be made use of by companies to compute the total of their workers withholding federal income tax.

April 2 2021. The discussion on the alterna-tive methods for figuring federal income tax withholding and the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members are no longer included in Pub15-A. This information is now included in Pub.

2021 Federal Tax Withholding Tables As with any other before year the freshly altered 2021 Federal Tax Withholding Tables was launched by IRS to prepare with this years tax time of year. By the amount of cash being held back the workers have the. Its also possible to Download valid tables in various other trustworthy resources.

February 18 2021 by Kevin E. Biweekly Federal Withholding Table 2020 If you are a company then it is necessary to understand just how employment tax rates are measured as well as renewed yearly. Federal Withholding Tables 2021 Biweekly.

Federal Withholding Tables 2021 Biweekly Download One of the most current version of federal income tax withholding tables 2021 can be downloaded at the official IRS site under Magazine 15-T. Federal Withholding Tables 2021 Biweekly. It includes the publications instructions and the type.

2021 Biweekly Federal Tax Withholding Chart The full guidelines of Federal Income Tax Withholding are issued by the IRS Internal Revenue Service annually. The rates impact just how much worker salaries or wages that you require to withhold. Magazine 15-T is a supplement file for Magazine 15 of Guide for Employers Tax and also Agricultural Employers Tax.

Tax on wages paid during the period from September 1 2020 through December 31 2020. By Federal Withholding Tables. The employer will use Worksheet 3 and the withholding tables in section 3 to determine the income tax withholding for the nonresident alien employee.

Employer Federal Tax Withholding Tables 2021. If the employee has submitted a 2020 or later Form W-4 and has entered an Annual Dependent Tax Credit in step 3 of the Form W-4 divide the Annual Dependent Tax Credit by. Government in which employers deduct taxes from their workers pay-roll.

Calculating Your Federal Withholding Tax To calculate your federal withholding tax find your tax status on your W-4 Form. The biweekly personal exemption value for each federal tax allowance changed to 16150 per allowance. February 18 2021 by Kevin E.

To determine the amount of wages subject to federal tax you must first add any taxable fringe benefits and taxable employer-paid deductions to your gross pay amount. Read better to understand just how the procedure works officially. Read even more to comprehend exactly how the procedure works officially.

Federal Withholding Tables. The deferral of the withholding and payment of the employee share of social security tax was available for employees whose social security wages paid for a biweekly pay period were less than 4000 or the equivalent threshold amount for other pay periods. This year of 2021 is additionally not an exemption.

Biweekly Federal Withholding Tax Tables 2021 Federal Withholding Tables 2021 is the process called for by the US. This year of 2021 is also not an exception. To use the new federal withholding tax table that corresponds with the new Form W-4 first find the employees adjusted wage amount.

Based on the number of withholding allowances claimed on your W-4 Form and the amount of wages calculate the amount of taxes. By Federal Withholding Tables. You can then subtract 15190 from the total biweekly taxable gross pay for each withholding allowance claimed.

The dollar amounts for the withholding tables and withholding rates 10 12 22 24 32 35 and 37 have also changed see Federal Income Tax Withholding table. Biweekly Federal Withholding Table 2021 The complete instructions of Federal Income Tax Withholding are provided by the IRS Internal Revenue Service annually. You can do this by completing Step 1 on Worksheet 2.

It contains many changes such as the tax bracket changes and the tax level annually along with the option to employ a computational link.

Federal Tax Withholding Tables 2021

2019 Biweekly Payroll Calendar Template Lovely Federal Bi Weekly Payroll Calendar 2018 Print Calendar Monthly Calendar Template Calendar Printables

The Get Rich Not So Quick 2014 Bi Weekly Pay Schedule How To Get Rich Bi Weekly Pay Calendar 2014

Ise The Appropriate Table To Determine The Amount To Chegg Com

Federal Withholding Tax Table For Wages Paid January 1 2012

Federal Tax Filing Requirements For Employers Study Com

Pin On Example Document Templates Design Printable

California Withholding Tax Rate Table 5 Effective January 1 2012

Pin On Document Template Example

Irs Withholding Tables And A Bigger Paycheck In 2018

Image Result For Free Printable 2018 2019 Calendar Excel Calendar Calendar Template Marketing Calendar Template

Wage Bracket Method Tables For Income Tax Withholding Chegg Com

Note Use The Tax Tables To Calculate The Answers To Chegg Com

Federal Withholding Table 2021 Payroll Calendar

The Following Table Shows The Federal Income Tax For A Single Person For A Biweekly Payroll Period Brainly Com

Pin On Document Template Example

The Treasury Department Just Released Updated Tax Withholding Tables That Will Change Your Paycheck Mother Jones Paycheck You Changed Release

2019 Payroll Calendar Template Unique Usps Pay Period Calendar 2019 Template Calendar Design Payroll Calendar Calendar Template Calendar Printables

Payroll T Shirt Organic Cotton Unisex Etsy Payroll Organic Cotton Holiday Pay

Posting Komentar untuk "Federal Tax Withholding Tables Biweekly"